with the Leading DeFi Protocol for Unified Cross-Chain Balances

New Roadmap Release

New Roadmap Release

Faster, cheaper, consistently reliable on-chain transactions

Compatible with all networks, transactions, and tokens

A single per-token balance across networks

MONO is used to pay paymaster fees for “universal gas,” and quoting/routing/Resource Lock fees.

Network operators (bundlers, messaging/observability nodes, orchestrator) stake MONO as economic security and earn a share of protocol fees.

Solvers/routers lock MONO as performance bonds to guarantee “instant execution” under theResource Locks model.

Mono Protocol's journey: From pilot model to a complete AI Blockchain ecosystem

Brand & messaging: website v1, docs v0, pitch deck, one-pager

Litepaper + tokenomics draft; publish public roadmap; legal/compliance review for presale

Presale smart contracts & audits; whitelist + KYC/geo-controls (where applicable)

Community growth: Discord/Telegram, ambassador program, early builder waitlist

Developer preview: SDK alpha (JS), reference dApp, MoUs with design partners

Throughput upgrade and parallel routing

Bug Bounty v2 with public stress tests

Validator/Relayer stability improvements

Unified SDK + partner sandbox

New chains: Solana full + 2-3 from BTC-layer / TRON / TON / SUI

Unified Balance v2 with non-EVM support

Infra partnerships (custody, paymasters, liquidity)

Grants Wave 2 for dApps

Developer adoption sprint

Listing on CEX and DEX

Staking + execution bonds

Universal Gas Module rollout

Liquidity partnerships

Adoption boost campaign

Mono Protocol v1.0 release

Enterprise layer (policies, audit trails)

MEV-Shield v2

Cross-chain payments module

Liquidity pool expansion and LP incentives

Mono Protocol is a chain-abstraction protocol that unifies per-token balances across chains and enables instant, MEV-resilient execution—so users transact anywhere with one account, one balance, one click.

Mono participants help bootstrap the unified-balance network and contribute to how the protocol evolves. The presale offers priority access to ecosystem features, governance participation, and utility within fee-tier and QoS systems as the network grows. Allocations are released in phases to support an orderly rollout. (Not investment advice; always do your own research.)

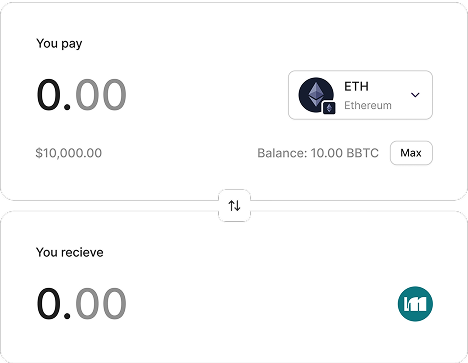

The minimum investment amount is $10.

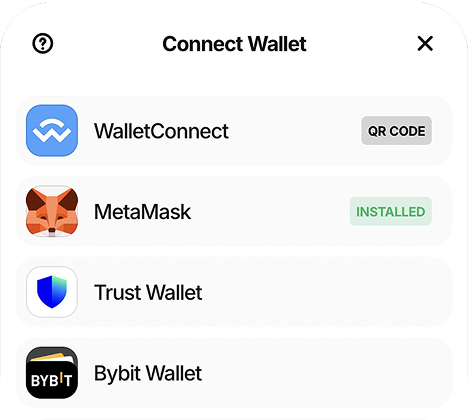

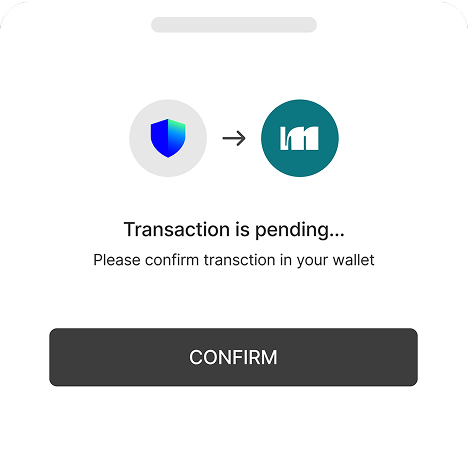

To participate, go to the official presale page via dashboard.monoprotocol.com, connect a supported wallet, choose an accepted asset, and confirm the transaction to receive your allocation receipt. You’ll be able to claim $MONO after TGE according to the published schedule.

The listing will be announced after all presale stages are completed, with timelines shared via our official channels.